For example, think about all of the divorces that will come out of quarantining with the one we thought we loved. On the flip side, think of all the holiday babies we’re going to see after quarantining with the one we really, really love. Of course, you can learn a new skill, exercise and lose some weight, stop drinking, start drinking, stop cooking and order takeout to support local business, or start cooking in an effort to save money to give yourself runway into the unknown.

That’s all great, however, this newfound free time just so happens to coincide with massive economic disruption. A disturbance that has impacted each of us in one way or another. As such, it only makes sense to use this time to safeguard yourself by assessing your current retirement strategy (and overall personal financial landscape) or thoughtfully devising one if you’re without a retirement strategy or, worse yet, any sense of where you stand with money.

While it might seem trite, we can all use our current state of affairs as a wake-up call. This could be little more than a minor reassessment that leads to a reaffirmation that you’re on the right track and have been all along. It could prompt adjustments to your present portfolio. Or it could be the opportunity you needed to hatch a plan from scratch. To that end, there’s a good chance that, with all of this time on your hands, you have come across Seeking Alpha for the first time or rediscovered it after previous fits and starts. In The REIT Forum, we’re here for the long haul to help investors and guide them through income-investing strategies built not only for retirement, but to navigate times such as the ones we’re experiencing now.

Back To Basics

If our current state of affairs has taught us nothing else (even though we all know it has), it has brutally instructed us to take nothing for granted. From that, I personally feel like you can no longer leave any stone unturned. Focus on the little details we can easily overlook. For example, even if you consider yourself a seasoned investor with all of your retirement ducks in a row, are you absolutely following crucial personal finance basics to the tee?

Assess your debt. Do you have credit card debt? What’s the interest rate? Does it make sense to carry high-interest debt and invest at the same time? Should you clear that debt before plowing more money into a portfolio?

Do you have a mortgage? Do you have a car payment? Do you have student loans? Are you paying for someone else’s student loans or their present education? Reevaluate it all, then make a fresh decision (even if it happens to maintain the status quo) for life under a new normal. Life that coincides with your long-term retirement investment strategy.

Do you have plans in place to send kids to college? If so, maybe it’s time for a wholesale rethink of that all-too-typical mindset. The last thing you want to do is take on more debt or layout savings/sell investments for something that wasn’t necessary before the Coronavirus crisis and certainly might not be after it.

Emergency Fund. Everyone says they have an emergency fund. Among investors, you’re likely to get shamed if you don’t. But I wonder, if we’re all being honest, how many of us either do not have an emergency fund OR don’t have one sufficient enough to ride out, oh let’s say, a global pandemic that wipes out three years’ worth of stock market gains, puts millions of people out of work overnight, shuts down a vast majority of the nation’s commerce, and relegates us to scrounging for random boxes of macaroni after waiting in line - six feet apart from our neighbor - at the grocery store.

While I’m not making an official proclamation, I would lightly argue that the new normal ought to dictate an emergency fund double what the “experts” have always told us we need. So, maybe enough cash to ride out six to nine months (or a year) rather than three to six months? Before you invest money for the long term, it’s probably smart to ensure you have easy access to cash for short-term emergencies, whether it’s your standard layoff or global calamity.

The last thing you want to do is face a need for cash and have to sell positions originally earmarked for long-term retirement investments to meet that need.

If nothing else (and we all know there’s lots else), maybe this will turn America into a nation of savers? Because saving is really, in two major ways, a prerequisite to investing, particularly a methodical style of income investing for retirement.

In one respect, as discussed, you need savings before you even consider investing. And, in a more symbolic or figurative sense, being a good saver sets the mental groundwork for being a disciplined investor. If you look at money with a perspective of “where can I put it to work for me, my family, my present, and my future” as opposed to “where can I needlessly spend it” you have put yourself on the beautiful path to financial freedom.

What Are Your Goals?

We all want to enjoy some form of retirement. But this is a great time to set short- to mid-range goals. Look around you and look at yourself. You see financial discomfort and even disaster all around you. You might be experiencing some level of it yourself.

First thing’s first - make sure priority No. 1 is to protect yourself from events that are out of your control. While the event might be out of your control, how you respond to it and how well equipped you are to navigate it remains firmly in your control. That takes us back to the emergency fund, but it also brings into focus something we probably don’t focus enough on - spending goals.

Even if you’re sitting pretty financially during this crisis, the thought has likely crossed your mind - where can I cut back? It’s a natural human reaction (I hope) as we all face a global threat together.

Should I hoard that toilet paper? Should I really eat steak for dinner tonight? If I cut back, am I helping somebody else simply achieve a baseline level of existence? And as I answer these and other questions, can I find areas where I don’t need to spend like I’m sitting pretty? Can the realization that I only actually need one pack of toilet paper or that I can eat tacos for dinner rather than steak lead to real action? Action in the form of accelerating the pace with which you build your emergency fund or scoop up buying opportunities during this otherworldly crash.

Then, of course, you have to consider your investment- and retirement-related goals. This, of course, is a conversation you can’t have without considering.

Your Aversion To Risk

We often talk about the lives and investment journey of Ted and Mary:

Ted and Mary saved up $510,000 for their retirement portfolio but want to live off a portfolio’s income. Ted and Mary have spent a couple of years reading investment strategy on Seeking Alpha.

They both know they need to be getting a lot of income from their portfolio if they aren't comfortable selling shares. They also learned to focus on a portfolio with lower volatility. After reading many articles on preferred shares, they agreed to use part of their portfolio invested in them. It will give them the income they are looking for and also be an investment that is in line with their risk levels.

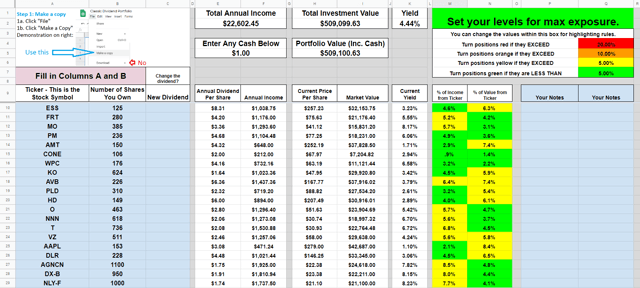

Their investment portfolio, excluding savings/cash accounts, may look like this:

Source: The REIT Forum's Classic Dividend Portfolio Tracker

That portfolio is built around 20 stocks:

| Ticker |

Company Name |

| (ESS) |

Essex Property Trust |

| (FRT) |

Federal Realty Investment Trust |

| (MO) |

Altria Group |

| (PM) |

Philip Morris International Inc |

| (AMT) |

American Tower Corp |

| (CONE) |

CyrusOne Inc. |

| (WPC) |

W.P. Carey & Co. Llc |

| (KO) |

Coca-Cola Company |

| (AVB) |

Avalonbay Communities |

| (PLD) |

Prologis Inc |

| (HD) |

Home Depot |

| (O) |

Realty Income Corp |

| (NNN) |

National Retail Properties |

| (T) |

AT&T Inc |

| (VZ) |

Verizon Communications Inc |

| (AAPL) |

Apple |

| (DLR.PK) |

Digital Realty Trust |

| (AGNCN) |

AGNC Preferred Share |

| (DX.PB) |

Dynex Capital Inc |

| (NLY.PF) |

Annaly Capital Management Inc Pfd |

However you decide to structure your portfolio - including preferred shares or not - it’s key to make sure you stick to it. To be able to stick to it, you have to determine the amount of risk you’re comfortable living with. This is the ideal time to make that assessment.

If you have a retirement portfolio constructed, look at what has happened (and is happening) to each position. Are you OK with the (temporary) loss of principal? Are you of the mind to add to positions that have dropped or even have been decimated? Or are you feeling anxiety that makes you want to sell? Does the income you receive from these positions offset the (again, most likely, temporary) downside? These are questions you need to ask as a current or prospective retirement investor.

We’re doing lots of self checks and making adjustments now as individuals and a society. If you have symptoms, self isolate. If you don’t, stay home and stay six feet away from others when you do have to go out. If you’re fortunate enough to be healthy and don’t have to focus squarely on where your next meal is coming from, there’s never been a better time to check your portfolio’s health or get started so you feel secure headed toward retirement and able to weather any storm, no matter how unprecedented it is.

Diving Deeper National Retail Properties

One of the stocks we included in that portfolio was National Retail Properties. We often refer to stocks by their ticker rather than their full name. Consequently, we tend to just refer to National Retail Properties as NNN.

NNN is a dividend champion (over 25 years of consecutive dividend increases). We recently added shares to our own portfolio, so we're going to share the research that paved the way to our decision.

We'll start with a brief summary:

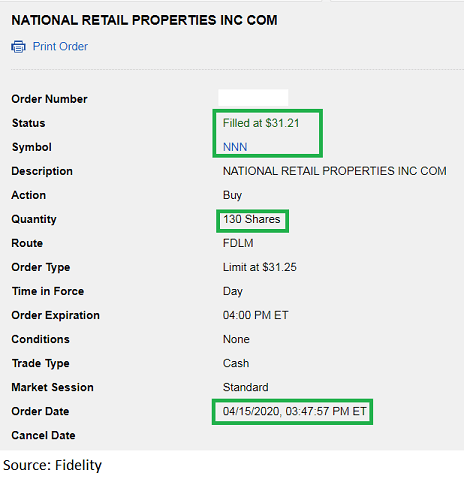

- We've added 130 shares of NNN to our portfolio at $31.21 per share. The position represents about 1% of our total portfolio.

- We want to continue gradually buying positions in high-quality equity REITs throughout the pandemic. We expect volatility to continue, but we like buying great REITs at good prices.

- This pandemic creates a major challenge for many of NNN's tenants. We should expect elevated tenant bankruptcies and requests for rent relief.

- Comparing the current situation to the Great Recession demonstrates the success NNN had in managing the recession and the value for investors who bought the plunge.

- Shares offer a 6.22% dividend yield which is thoroughly covered by AFFO per share. Near-term debt maturities are minimal. A very rare (and large) discount to NAV is present.

Opening Our Position

We added 130 shares of National Retail Properties to our portfolio Wednesday afternoon.

The weighted average price was $31.21 per share. We recently provided a triple net lease REIT sector update. NNN was one of the REITs we highlighted for an attractive valuation. Shares roared higher the next few days, before falling back down today on a disappointing report for consumer spending.

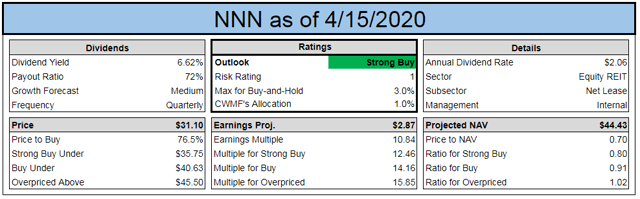

Shares land well within our strong buy range, which is ideal for entering our position:

Source: The REIT Forum

The purchase comes in at about 1% of our portfolio. That's a nice size for starting to build the position. It's enough to be material, but still small enough that we could add to it if the situation arises.

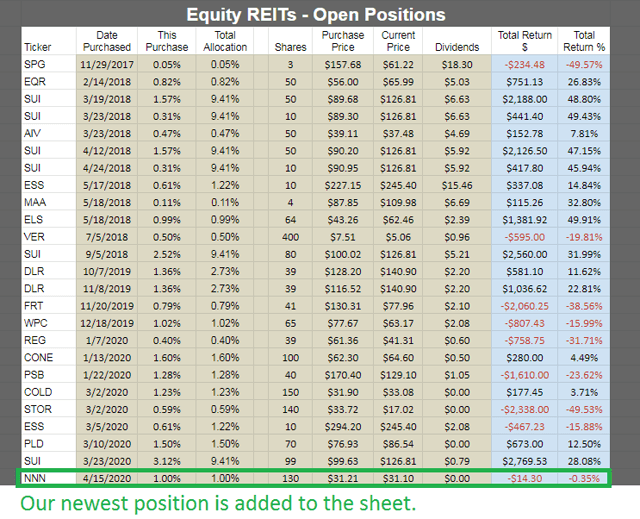

It's already included in The REIT Forum Google Sheets:

Source: The Returns Tab of the REIT Forum Google Sheets

Note: We haven't pulled the most recent ex-dividend dates for a few shares, so there may be a few where we still need to add the latest dividend to our "dividends" column and "total return" columns.

Current Environment

COVID-19 is a train wreck for triple net lease REITs. We need to start by addressing that issue. The sector (triple net lease REITs) benefit from exceptionally long lease terms, but many of their tenants are having a terrible time.

While we believe many restaurants will bounce back over the next year or two and find restaurants to be easier tenants to replace, we need to highlight the current temporary struggles. Sales at restaurants across the country are suffering, which is a major challenge. Some restaurants have decided to temporarily close locations down (doesn't eliminate rental obligations) because business is weak. We've seen several waiving delivery charges, which seems like a questionable choice. Delivery tends to be the least efficient way to serve customers because the companies operating as middlemen are not yet efficient. They markup prices for the customer and bill the restaurant, so both sides are losing.

The more efficient service to subsidize is "pick up." For orders placed through a company website and picked up in person, the marginal cost to the restaurant is usually $0.

It isn't just restaurants that are struggling. Many companies which rely on revenues generated through in-person business are struggling. Seeing share prices decline for landlords makes sense. We expect a higher volume of tenant bankruptcies over the next two years, despite small business loan programs designed to ease the burden.

Surviving Recessions

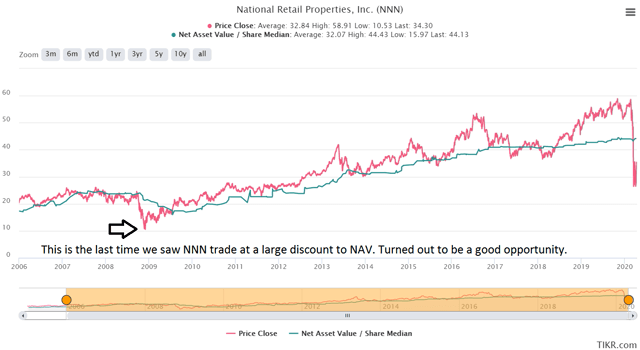

With the problems addressed, we want to discuss the positive factors. We're going to start by asking how the company survives in the midst of a terrible recession. For that, we'll use a chart:

Source: TIKR.com

NNN usually trades at a premium to NAV (net asset value). They generally deserve a premium, so it isn't surprising to see them getting one most of the time. Today, they trade at a dramatic discount. By our estimates, they are trading around 70% of the recent consensus estimate. We believe the consensus estimate will come down some with the recession, but it's still a significant discount on a great REIT.

In the great recession, the share price on NNN tanked. It was down extremely hard for a month or two. Within the span of a single year, it recovered most of the decline. Within two years, the share price was higher than it had been prior to the start of the recession.

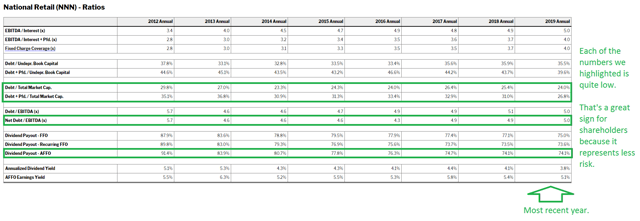

How did that happen? Management runs the company carefully. They avoid going overboard on debt, so they can withstand a hit when the economy turns ugly. We can demonstrate the careful approach from NNN's management by highlighting several financial ratios:

Source: REITbase.com

Debt plus preferred shares were only 26.8% of the total market capitalization. You can bet that number is dramatically higher now thanks to lower total market capitalization (due to common share prices). However, they went in with lower leverage.

The dividend payout ratio on AFFO (this is Analyst AFFO, which already is adjusted to reflect recurring cash flows) was about 74%.

That means NNN can withstand a significant drop in their AFFO per share and still have dividend coverage.

Having a low payout ratio during the good times is one of the keys to maintaining dividends through the hard times. Remember, NNN has over 25 consecutive years of dividend increases. That isn't an accident. They had to get through multiple recessions to create that record.

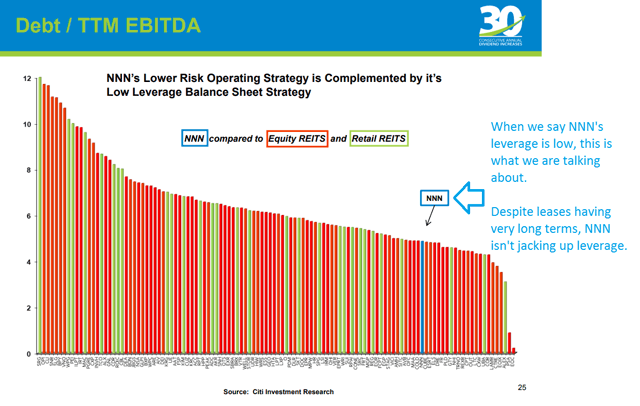

The net debt / EBITDA ratio was only 5.0. That's very good. Let's provide some perspective on that value:

Source: NNN

Compared to the universe of equity REITs in America, NNN was running pretty low on leverage. Combining long lease terms with low leverage is a great combination for stability.

The Business Model

One of the reasons we like triple net lease REITs is their business model. Many investors don't realize just how simple their business model can be. The triple net lease REIT is offloading most of the costs of ownership onto the tenant. Why would the tenant like that? Because they don't have to pay the substantial amount required to own the physical property. They simply need to pay for recurring expenses plus the rental payment.

That works for the landlord and the tenant because the landlord has a cheaper source of financing than the tenant. It's that simple. Using a combination of debt and equity markets, the triple net lease REIT can finance ownership of real estate at a lower cost than their tenant can. That creates an arbitrage opportunity where the tenant and landlord both win.

Because this system works quite well, triple net lease REITs usually trade above NAV. Because they often trade at significant premiums to NAV, they will hunt for new properties to purchase. When they have deals lined up and have a large premium to NAV, they will issue new shares and buy the properties. Since they do this when they trade at a premium to NAV, they promptly see an increase in NAV per share and usually see an increase in FFO (funds from operations) and AFFO (adjusted funds from operations) per share within a few quarters.

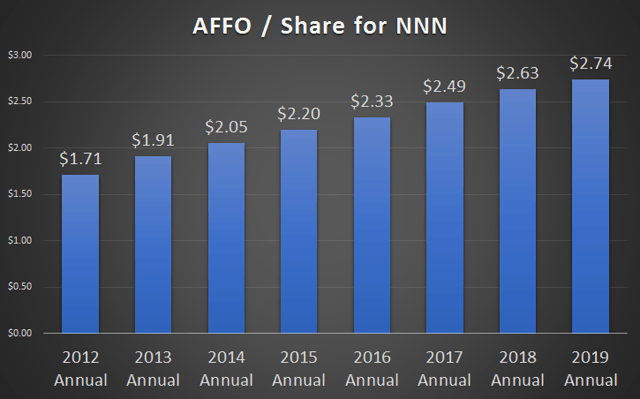

Growing AFFO Per Share

With such a simple and effective business model, they've been able to consistently generate growth in AFFO per share:

Source: Author's chart created with data from REITbase.com

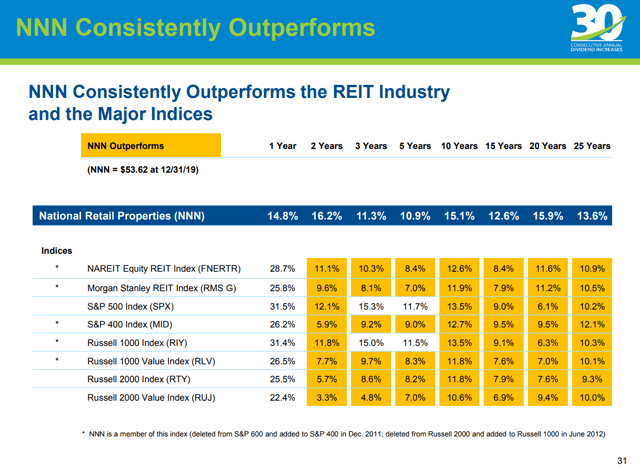

The simple strategy of consistently growing AFFO per share enabled NNN to significantly outperform most major indexes. Whether those indexes were based on REITs or other stock indexes, NNN won most of the time:

Occupancy

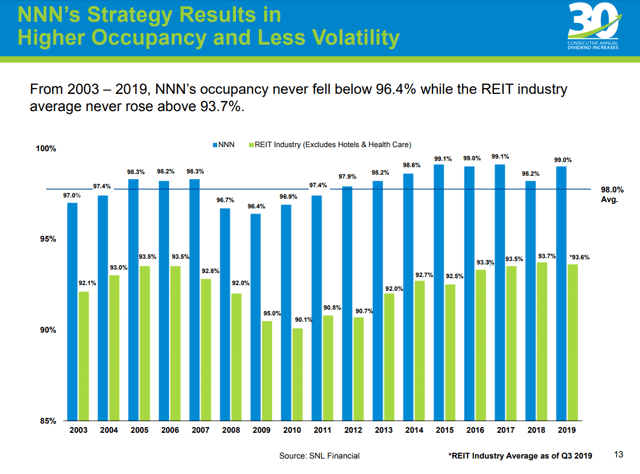

Bankruptcies are a major concern. They were a major concern during the Great Recession as well. Yet NNN's occupancy rate did not fall below 96%:

Source: NNN

So how far do we really expect occupancy to fall?

Yes, COVID-19 is a major risk. We see it creating a substantial amount of economic disruption. It's certainly different from the great recession. COVID-19 involves unique challenges. However, the Great Recession came from the real estate market. That made it particularly bad for companies that owned real estate. So we can't say COVID-19 is "worse" for landlords.

We expect to see some tenant bankruptcies and we expect to see some tenants requesting relief on rents. That's part of a recession. It happens. This is a great team with experience navigating through the prior recession.

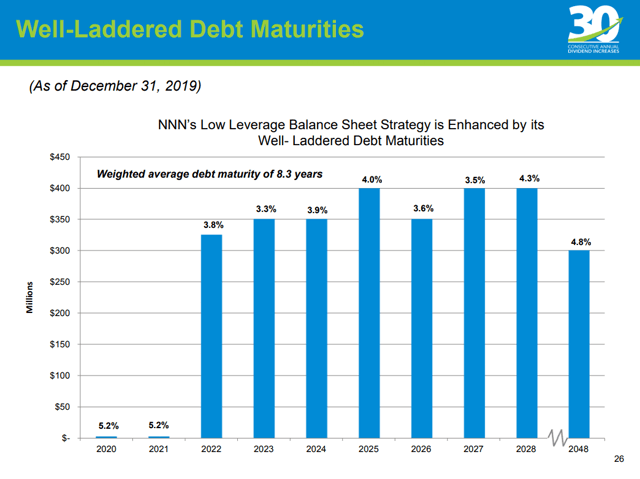

They Do Not Need Debt

One major risk for any company right now would be needing to refinance their debt. That isn't the case here. NNN has only a minimal amount of debt maturing in 2020 and 2021. That debt was at 5.2%, so they may still be able to refinance even that tiny amount at a lower interest rate:

This is another important part of managing an equity REIT. They need to be ready to pay any major obligations a bit in advance so they can avoid needing capital at precisely the wrong time.

If someone thinks "NNN might be forced to issue shares" we have to ask what those people think NNN would need the money for.

How Cash Flows Through NNN

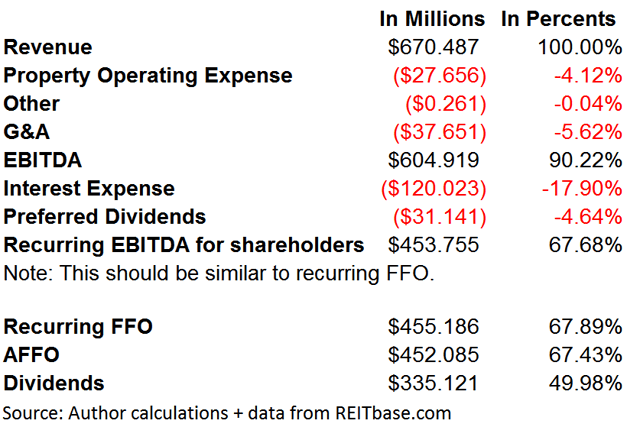

To demonstrate why NNN wouldn't be "forced" into a bad transaction, we want to highlight how cash flows through the REIT. We're doing that by simplifying the income statement into a format that will be much easier for investors to understand. Then we're showing the values in dollar amounts and in percentages:

We find that the recurring EBITDA for shareholders is very similar to recurring FFO. That should consistently be the case. In this case, they are extremely similar.

We can see that last year the company used the first 9.8% of revenue to cover all of their operating expenses. They used 17.9% for interest payments and 4.64% to pay preferred shares. The rest, nearly 68%, was available for the benefit of common shareholders. They used some to pay dividends and some to reinvest in the company.

What About Leasing Costs?

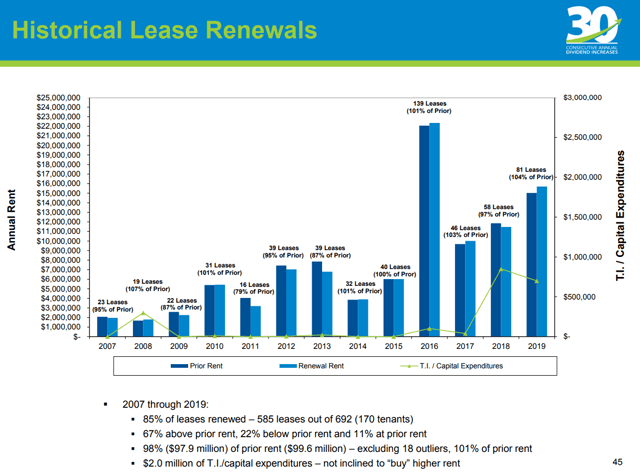

For many landlords, especially those owning "retail" properties, one of the major recurring expenses is "TIs" which stands for "Tenant Improvements." You may notice that this number spiked higher for NNN, but don't worry:

While the cost for tenant improvements did spike higher, it's measured on the axis to the right. The highest value, occurring in 2018, was less than $1 million. To a REIT with total revenues of $670 million last year, that isn't material. That's less than 0.2%. Is a spike of 0.2% worth worrying about? We don't think so.

FFO Per Share

The consensus estimate for FFO per share was $2.87. That would've been a reasonable growth rate over last year's $2.76 in recurring FFO (using REITbase's values).

We expect that due to tenant bankruptcy, the number for 2020 will come in materially lower than the current estimate of $2.87. We can live with that, given the valuation.

At $31.10, shares are trading at only 10.84x that projected FFO. Even if FFO per share came in 10% below that level, we would be paying under 12x FFO and the dividend would be thoroughly covered. If FFO per share declined 20%, the dividend would still be covered. To get that kind of decline, you'd need an incredible amount of bankruptcies.

Conclusion

The pandemic is creating significant risks to real estate. However, it's also creating much better entry prices. We're looking to gradually build our positions in equity REITs by buying small positions when the pricing looks favorable. We expect to see damage from COVID-19, but it won't force us to stay on the sidelines.

NNN is one of the REITs we believe will fit buy-and-hold investors very well. Shares carry a risk rating of 1. Their dividend is solidly covered, despite a strong yield of 6.62%. We expect dividend growth to continue at a medium rate for the foreseeable future, though they might opt to use a slower rate in the near-term depending on the severity of the pandemic. This kind of sale has been extremely unusual on the high-quality triple net lease REITs, so we're taking advantage. Prior to this pandemic, we haven't seen such a large discount since the Great Recession.