The trend has been moving in a positive direction: Over the past decade, far more workers who are eligible for Social Security have been waiting to file, often substantially increasing their lifetime annual benefits.

But the stunning job losses in the pandemic-induced economic crisis could bring this trend to a crashing halt, as suddenly unemployed older workers without substantial savings scramble to meet living expenses.

At a time when fewer retired households can rely on traditional pensions and only about half own retirement accounts, Social Security is the most important benefit for most Americans. Even in good times, there is no simple, one-size-fits-all answer when it comes to timing a claim — your longevity, savings and any other pension income are important factors.

Now the decision is complicated by the highly uncertain outlook for the economy, jobs and financial markets. But even if you need Social Security income immediately, you may have options worth considering that can boost lifetime benefits.

Let’s review the pros and cons of different strategies for claiming benefits during the coronavirus pandemic.

I need income now. Why wait to claim Social Security?

Your claiming age matters a great deal. You can file as early as 62, but your annual benefit will be higher for every year you wait, until 70.

Social Security uses an actuarial formula tied to your full retirement age — the point at which you can claim 100 percent of the benefit you’ve earned over the course of your working life. For example, if you turn 62 this year, your full retirement age is 66 and 8 months.

If you file before your full age, your benefit will be reduced as much as 6.7 percent annually, depending on when you claim. The bite is bigger than in the past because of changes enacted in 1983, when a gradual increase in the full retirement age from 65 to 67 was set in motion. Those increases, which still are being phased in, effectively set the bar higher for claiming a full benefit.

Filing at 62 this year means you’ll receive 72 percent of your full benefit, noted Richard W. Johnson, director of the program on retirement policy at the Urban Institute, compared with 80 percent for someone who was born in 1937 or earlier and retired at that age (when the full age was still 65).

“That lower income can really sting when you reach your 80s and out-of-pocket medical expenses and spending on home and residential care often surge,” Mr. Johnson said.

Filing after your full retirement age yields an even larger increase: 8 percent for every 12 months of delay up to age 70. That’s a much higher guaranteed return than you could get in any financial instrument, and benefits are adjusted annually for inflation.

Even a delay of a year or two past the full age can meaningfully increase benefits and mitigate your risk of falling short of income in retirement.

“Delaying your Social Security claim is the optimal strategy for anyone who is reasonably healthy and likely to live beyond the average longevity of an American,” said Michael Finke, a professor at the American College of Financial Services.

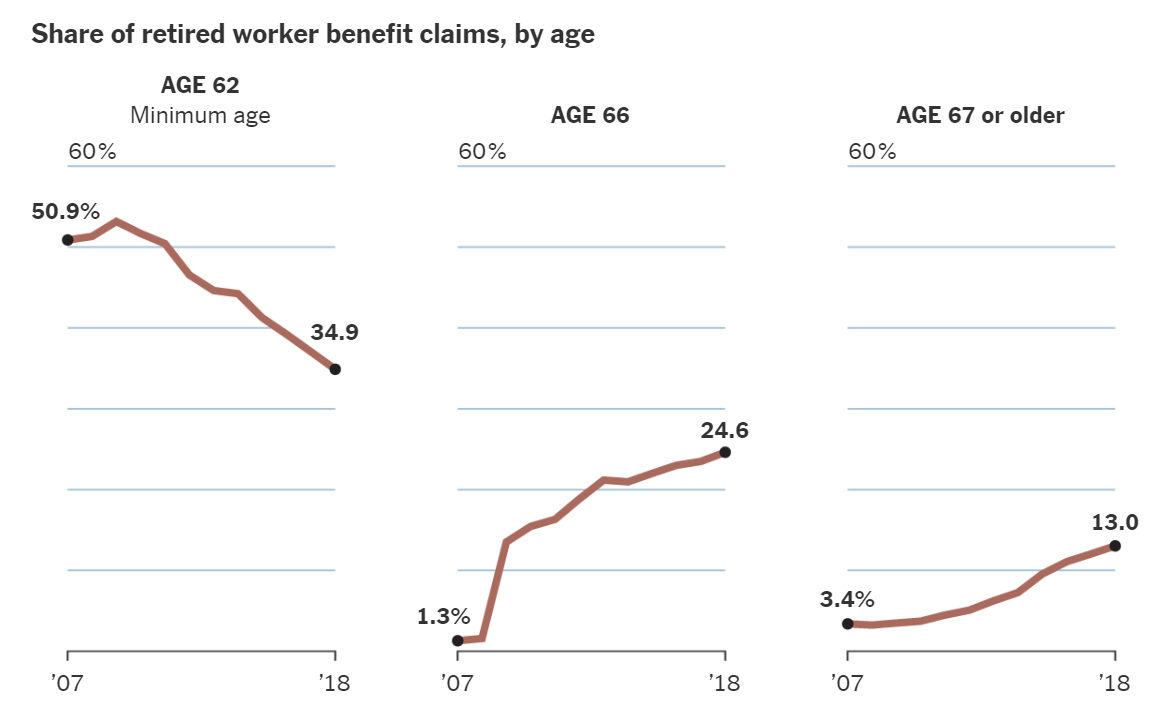

During the 2008 recession, early claiming jumped as large numbers of workers were forced to retire, Mr. Johnson said. But the trend has shifted decisively since then: For example, the share of people claiming at 62 fell to 35 percent in 2018 from 53 percent in 2009.

Trends in Claiming Social Security

Early Social Security benefit claims jumped during the 2008 recession. But since then, the trend has shifted decisively toward later claiming.

Note: The sudden jump in claims in 2009 by those aged 66 is attributable to a change in full retirement age to 66 from 65 for those born between 1943 and 1954.

By The New York Times | Source: Urban Institute analysis of Social Security Administration data.

That positive trend now seems likely to stall or even reverse, Mr. Johnson said.

“A lot of older people losing jobs now are going to be unemployed for a long time, and my fear is that many of them are never going to work again,” he said. “They’re going to end up taking Social Security and dipping into their retirement accounts earlier than expected, and that is going to have serious consequences for their economic security at age 70 and 80.”

I have some savings. Should I live on that rather than claim Social Security now?

This is a very personal decision that depends greatly on your circumstances. Maintaining an emergency fund is always important, and never more so than during times of economic volatility. But people with very substantial savings can draw down safely to cover living expenses while delaying their claim.

The loss of earned income means you will be in a lower tax bracket, and rates are at historically low levels under the Tax Cuts and Jobs Act of 2017.

“There’s no better time to take money out of a 401(k) or I.R.A. than when your income is relatively low and you have a lower marginal tax rate,” Mr. Finke said.

A delay of just a few years can be very beneficial. A 62-year-old with a full retirement age benefit of $1,500 would increase her likely lifetime benefits by more than $100,000 by waiting until that point to file, according to a projection by William Meyer, a co-founder of Social Security Solutions, which offers software aimed at helping retirees make optimal claiming decisions. Mr. Meyer’s calculation assumes that our retiree lives to 90 and that Social Security’s cost-of-living adjustment is 2 percent each year.

But the pandemic has added a new dimension to claiming decisions for most retirees, the retirement researcher Dirk Cotton said. Since most Americans have modest savings, if any, many of them will need to hang on to what they have.

“I know that I can either get Social Security income now, or shift some of it to the future if I think I might need it more later than I do today,” he said. “But the question now is whether the pandemic has changed our thinking enough about the future to affect that decision, and the answer is, ‘Absolutely, yes.’”

For example, the future economic security of adult children might favor an early Social Security claim over drawing down savings now, Mr. Cotton argued.

“What if your children have jobs that now are gone or hanging by a thread?” he asked. “You’re going to want to have assets available to help them.”

Persistent bear market conditions also present an argument in favor of an early claim, Mr. Cotton added.

“Can you count on your portfolio to generate the kind of income you had expected earlier?” he asked. “If the market is dropping, you may have to sell off more of your portfolio each year than you had expected, but claiming early Social Security would relieve some of that pressure.”

I don’t have anything saved. What should I do?

Your options are limited here, but there are moves that may get some Social Security income flowing now while preserving the possibility of higher benefits later.

One strategy is to claim benefits now but suspend them later to accumulate what are known as delayed retirement credits. Let’s say our out-of-work 62-year-old claimant finds a new job at 64. When she reaches her full retirement age, she could suspend her benefits and begin accruing delayed credits, calculated from her already reduced benefit. Doing so would add roughly $50,000 to her lifetime benefit, Mr. Meyer said. And if she waits until 63 to make her initial filing and then executes this suspend strategy, the addition to her likely lifetime payout will rise to about $71,000.

“You can only suspend once, but it does add an element of flexibility that can result in more cumulative benefits,” Mr. Meyer said.

People who gain new employment while receiving Social Security should be aware of one complication here. It’s called the retirement earnings test.

If you claim benefits before your full retirement age and keep working, Social Security withholds a portion of your benefits if your earnings exceed certain amounts, a figure known as the exempt amount. (For 2020, the exempt amount is $18,240; for people attaining full retirement this year, the exempt amount is $48,600, applied only to earnings in months before the month of full retirement age attainment.)

Social Security withholds $1 in benefits for every $2 of earnings in excess of the exempt amount. But the reduced benefits are not lost permanently. When you reach your full retirement age, your monthly benefit will be increased permanently to account for the months when benefits were withheld.

Married couples have an important additional option for increasing their household benefit: One spouse claims early while the other delays. Consider a couple in which one spouse is 66 and the other 63. The older spouse has a full retirement benefit of $2,400, and the younger spouse can expect a full benefit of $1,500.

Mr. Meyer calculates that if both file now rather than at full retirement age, they forgo as much at $59,000 in lifetime benefits, and $275,000 compared with delaying to age 70. If the younger, lower-earning spouse is laid off and starts benefits now but the older, higher-earning spouse delays starting benefits until 70, they will have $170,000 more in benefits than if they both start benefits right away.

How does my longevity figure into this?

This question underscores an important caveat accompanying Mr. Meyer’s projections, which assume a life span to 90: Not only may your mileage vary — it certainly will. Financial advisers routinely illustrate outcomes assuming long life spans as a way to test the retirement plans they draw up.

Men who reach 65 have a 33 percent chance of living to 90, and women a 44 percent chance, according to the Society of Actuaries. And for married couples, there’s a 63 percent chance that one spouse will live to at least 90. Yet a recent study by the society found that half of us wrongly estimate our life expectancy by five or more years, with 23 percent overestimating and 28 percent underestimating.

Those numbers illustrate the classic argument for Social Security’s value as insurance against outliving our financial resources. But the challenges of the pandemic economy may turn that argument on its head.

“Sometimes an economic analysis points to what seems like a good decision for a large group of people,” Mr. Cotton said. “Economics can tell you what’s best for an entire group of people — but you’re one person. It’s something you need to decide on your own.”

How do I determine my benefit amount and file?

If you have an account on the Social Security website, you can download your personal statement of benefits, which includes your estimated benefit amount at various ages. The statement also includes your lifetime wage history; check this to make sure it looks accurate. If you haven’t established an account yet, you can do that at any time; it’s useful to have one, since Social Security mails out paper statements only periodically these days.

The Social Security field offices are closed to the public for most routine transactions during the pandemic. If you want to claim benefits now, filing online will be your most convenient option. Services are also available via the agency’s toll-free line, 800-772-1213, but be prepared for long delays.